Seasonal data analysis in Python involves examining available data of past sales in an effort to draw a forecast of what future sales are likely to be, this can be vital for many reasons such as knowing how much inventory to have on hand as well as arranging marketing activities around this. The methods in this article can be used to examine a variety of different seasonal data so the intention of this series is to examine the various steps that can be taken to fine-tune the accuracy of the forecast model. Part 1 will be fun on the data set with no true tuning and in future articles we will look at segmenting the data by region and/or vehicle type to see how this affects the accuracy of the forecast as well as trialling limiting the time periods to eliminate anomalous data. In Part 2 we examine the effect of segmentation on the accuracy of the forecast.

We will be examining new car sales in Australia, utilising the data provided by the Australian Bureau of Statistics; this report is provided every year and details the sales for each calendar year since 1994. To test the most accurate method of running a forecast we will be passing various sets of data through the pylab library. My chosen environment is Jupyter Notebooks but there are several available.

First we need to import the libraries that we are going to use during this examination;

import warnings

import itertools

import numpy as np

import matplotlib.pyplot as plt

warnings.filterwarnings("ignore")

plt.style.use('fivethirtyeight')

imdport pandas as pd

import statsmodels.api as sm

import matplotlib

from pylab import rcParams

matplotlib.rcParams['axes.labelsize'] = 14

matplotlib.rcParams['xtick.labelsize'] = 12

matplotlib.rcParams['text.color'] = 'k'Then we we are going to import the Excel file from the Australian Bureau of Statistics and have a look at the head of it to see what kind of data we are dealing with;

df = pd.read_excel("NEWMVSALES.xls")

print(df.head(5)) MEASURE Measure VEHICLE Vehicle Type ASGS_2011 Region \

0 1 Number 100 Passenger vehicles 1 New South Wales

1 1 Number 100 Passenger vehicles 1 New South Wales

2 1 Number 100 Passenger vehicles 1 New South Wales

3 1 Number 100 Passenger vehicles 1 New South Wales

4 1 Number 100 Passenger vehicles 1 New South Wales

TSEST Adjustment Type FREQUENCY Frequency TIME Time Value \

0 20 Seasonally Adjusted M Monthly 1994-01 Jan-1994 13107.8

1 20 Seasonally Adjusted M Monthly 1994-02 Feb-1994 13710.6

2 20 Seasonally Adjusted M Monthly 1994-03 Mar-1994 13562.4

3 20 Seasonally Adjusted M Monthly 1994-04 Apr-1994 13786.9

4 20 Seasonally Adjusted M Monthly 1994-05 May-1994 13871.1

Flag Codes Flags

0 NaN NaN

1 NaN NaN

2 NaN NaN

3 NaN NaN

4 NaN NaN We can see there are several classification parameters such as Vehicle Type, Region, Adjustment Type, and Frequency but first, we will get a sense of the shape of the other data.

df.describe()MEASURE VEHICLE ASGS_2011 TSEST Value Flag Codes

count 31104.0 31104.000000 31104.00000 31104.000000 31104.000000 0.0

mean 1.0 425.000000 4.00000 20.000000 8623.252701 NaN

std 0.0 311.252493 2.58203 8.165097 15316.647740 NaN

min 1.0 100.000000 0.00000 10.000000 30.000000 NaN

25% 1.0 175.000000 2.00000 10.000000 761.925000 NaN

50% 1.0 350.000000 4.00000 20.000000 2903.100000 NaN

75% 1.0 600.000000 6.00000 30.000000 9714.325000 NaN

max 1.0 900.000000 8.00000 30.000000 134171.000000 NaN| MEASURE | VEHICLE | ASGS_2011 | TSEST | Value | Flag Codes | |

| count | 31104.0 | 31104.000000 | 31104.00000 | 31104.000000 | 31104.000000 | 0.0 |

| mean | 1.0 | 425.000000 | 4.00000 | 20.000000 | 8623.252701 | NaN |

| std | 0.0 | 311.252493 | 2.58203 | 8.165097 | 15316.647740 | NaN |

| min | 1.0 | 100.000000 | 0.00000 | 10.000000 | 30.000000 | NaN |

| 25% | 1.0 | 175.000000 | 2.00000 | 10.000000 | 761.925000 | NaN |

| 50% | 1.0 | 350.000000 | 4.00000 | 20.000000 | 2903.100000 | NaN |

| 75% | 1.0 | 600.000000 | 6.00000 | 30.000000 | 9714.325000 | NaN |

| max | 1.0 | 900.000000 | 8.00000 | 30.000000 | 134171.000000 | NaN |

Given that Flag Codes and Flag contain only empty cells we can disregard them. Measure and Vehicle columns are doubled up utilising both numbers as a classification, the above output of Measure shows that the entire data set has the same classification so we can disregard this column also, for ease of readability we will use the non-numeric Vehicle Type instead of the numeric classification; the only numerical columns that we will be interested in is the Value column.

Let’s get a full list of columns then examine and have a look at the unique values in each of the classification columns to see what we want to use for our first model.

print(df.columns)Index(['MEASURE', 'Measure', 'VEHICLE', 'Vehicle Type', 'ASGS_2011', 'Region',

'TSEST', 'Adjustment Type', 'FREQUENCY', 'Frequency', 'TIME', 'Time',

'Value', 'Flag Codes', 'Flags'],

dtype='object')print("Vehicle type values are: " + str(df['Vehicle Type'].unique())+"\n")

print("Region values are: " + str(df['Region'].unique())+"\n")

print("Adjustment Type values are: " + str(df['Adjustment Type'].unique())+"\n")Vehicle type values are: ['Passenger vehicles' 'Other vehicles' 'Sports utility vehicles'

'Total Vehicles']

Region values are: ['New South Wales' 'South Australia' 'Western Australia' 'Tasmania'

'Victoria' 'Australian Capital Territory' 'Northern Territory'

'Australia' 'Queensland']

Adjustment Type values are: ['Seasonally Adjusted' 'Original' 'Trend']#set the desired data filters

all_cars = df.loc[df['Vehicle Type'] == 'Total Vehicles']

all_cars = all_cars.loc[all_cars['Adjustment Type'] == 'Original']

#all_cars_all_region['TIME'] = pd.to_datetime(all_cars['TIME'])

all_cars_all_region = all_cars.loc[all_cars['Region'] == 'Australia']

#select the colums that we want to examine, we'll keep Region to be able to use in future examinations

cols = 'TIME', 'Value', 'Region'

all_cars_all_region = pd.DataFrame(all_cars_all_region, columns = cols)

#convert the 'TIME' column to a datetime values

all_cars_all_region['TIME'] = pd.to_datetime(all_cars_all_region['TIME'])

#sort the values by date

all_cars_all_region.sort_values('TIME')

#check for any empty cells within our new data set

all_cars_all_region.isnull().sum()TIME 0<br>Value 0<br>Region 0<br>dtype: int64Let’s check what the time frame of the data is.

all_cars_all_region['TIME'].min(), all_cars_all_region['TIME'].max()(Timestamp('1994-01-01 00:00:00'), Timestamp('2017-12-01 00:00:00'))Finally, the last preparation step; index the time perimeter

all_cars_all_region = all_cars_all_region.set_index('TIME')

all_cars_all_region.indexDatetimeIndex(['1994-01-01', '1994-02-01', '1994-03-01', '1994-04-01',

'1994-05-01', '1994-06-01', '1994-07-01', '1994-08-01',

'1994-09-01', '1994-10-01',

...

'2017-03-01', '2017-04-01', '2017-05-01', '2017-06-01',

'2017-07-01', '2017-08-01', '2017-09-01', '2017-10-01',

'2017-11-01', '2017-12-01'],

dtype='datetime64[ns]', name='TIME', length=288, freq=None)Let’s check the result.

all_cars_all_region.head(10)| Value | Region | |

| TIME | ||

| 1994-01-01 | 35596.0 | Australia |

| 1994-02-01 | 47131.0 | Australia |

| 1994-03-01 | 56816.0 | Australia |

| 1994-04-01 | 43243.0 | Australia |

| 1994-05-01 | 52678.0 | Australia |

| 1994-06-01 | 64189.0 | Australia |

| 1994-07-01 | 48580.0 | Australia |

| 1994-08-01 | 52627.0 | Australia |

| 1994-09-01 | 52040.0 | Australia |

| 1994-10-01 | 52722.0 | Australia |

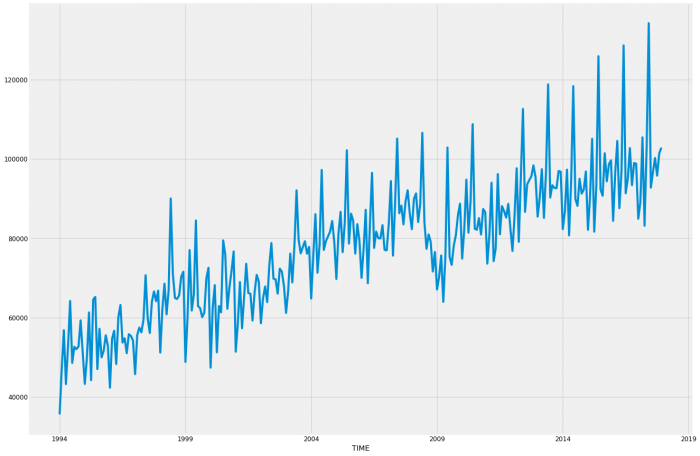

Excellent, everything looks ready. Let’s have a look at a graph of the data to get an idea of trends that have been experienced over the past 14 years.

y = all_cars_all_region['Value']

y.plot(figsize=(20, 15),x = None)

plt.show()

By this, we can see that it follows a similar pattern every year with relatively consistent growth except for 2008 and 2009 which matches up with the Global Financial Crisis. We will note that for later as it might impact our model, we may get better results by reducing the time period after this. For now, we will proceed with the entire data set.

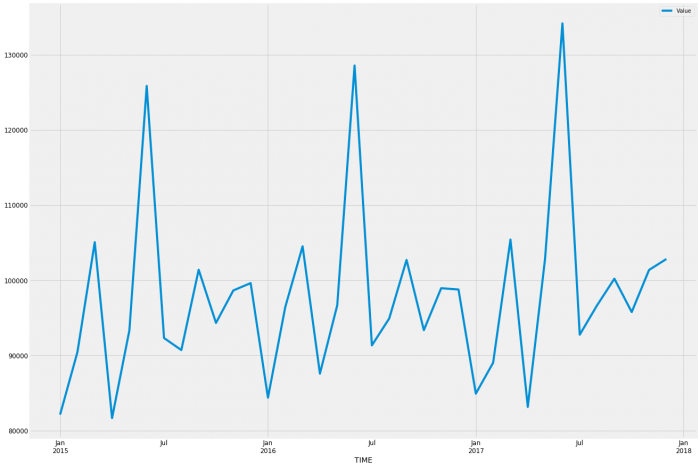

Let’s take a look at the sales pattern by looking at 3 years more closely;

z = all_cars_all_region['2015-01':'2017-12']

z.plot(figsize = (20,15),x = None)

plt.show()

So it looks like March, June, September, and December are the peak months; January, April, July, and August are all low sales months, likely due to the heavy sales the month before.

Let’s run our ARIMA model

#12 seasons chosen per year due to the clear pattern of 12 distinctly different monthly patterns.

p = d = q = range(0, 2)

pdq = list(itertools.product(p, d, q))

seasonal_pdq = [(x[0], x[1], x[2], 12) for x in list(itertools.product(p, d, q))]

print('Examples of parameter combinations for Seasonal ARIMA...')

print('SARIMAX: {} x {}'.format(pdq[1], seasonal_pdq[1]))

print('SARIMAX: {} x {}'.format(pdq[1], seasonal_pdq[2]))

print('SARIMAX: {} x {}'.format(pdq[2], seasonal_pdq[3]))

print('SARIMAX: {} x {}'.format(pdq[2], seasonal_pdq[4]))#Examples of parameter combinations for Seasonal ARIMA... SARIMAX: (0, 0, 1) x (0, 0, 1, 12)

SARIMAX: (0, 0, 1) x (0, 1, 0, 12)

SARIMAX: (0, 1, 0) x (0, 1, 1, 12)

SARIMAX: (0, 1, 0) x (1, 0, 0, 12)#initialise list to be able to hold results to make it easier to find the lowest result to find which model to use quicker

results_list = []

for param in pdq:

for param_seasonal in seasonal_pdq:

try:

mod = sm.tsa.statespace.SARIMAX(y,

order=param,

seasonal_order=param_seasonal,

enforce_stationarity=False,

enforce_invertibility=False)

results = mod.fit()

warnings.filterwarnings("ignore")

results_list.append(results.aic)

print('ARIMA{}x{}12 - AIC:{}'.format(param, param_seasonal, results.aic))

except:

continue

print("lowest result is " + str(min(results_list)))ARIMA(0, 0, 0)x(0, 0, 0, 12)12 - AIC:7293.293369312979

ARIMA(0, 0, 0)x(0, 0, 1, 12)12 - AIC:6815.078143900661

ARIMA(0, 0, 0)x(0, 1, 0, 12)12 - AIC:5643.460985883648

ARIMA(0, 0, 0)x(0, 1, 1, 12)12 - AIC:5393.229683485892

ARIMA(0, 0, 0)x(1, 0, 0, 12)12 - AIC:5648.249615304498

ARIMA(0, 0, 0)x(1, 0, 1, 12)12 - AIC:5619.83710706473

ARIMA(0, 0, 0)x(1, 1, 0, 12)12 - AIC:5408.357711483104

ARIMA(0, 0, 0)x(1, 1, 1, 12)12 - AIC:5390.889959479369

ARIMA(0, 0, 1)x(0, 0, 0, 12)12 - AIC:7070.676989709407

ARIMA(0, 0, 1)x(0, 0, 1, 12)12 - AIC:6722.307461993595

ARIMA(0, 0, 1)x(0, 1, 0, 12)12 - AIC:5549.687148257799

ARIMA(0, 0, 1)x(0, 1, 1, 12)12 - AIC:5298.961945427468

ARIMA(0, 0, 1)x(1, 0, 0, 12)12 - AIC:6744.487690038421

ARIMA(0, 0, 1)x(1, 0, 1, 12)12 - AIC:6697.5946667617645

ARIMA(0, 0, 1)x(1, 1, 0, 12)12 - AIC:5340.107258081442

ARIMA(0, 0, 1)x(1, 1, 1, 12)12 - AIC:5300.355784227131

ARIMA(0, 1, 0)x(0, 0, 0, 12)12 - AIC:6180.9815862504765

ARIMA(0, 1, 0)x(0, 0, 1, 12)12 - AIC:5792.313461934212

ARIMA(0, 1, 0)x(0, 1, 0, 12)12 - AIC:5557.459124697066

ARIMA(0, 1, 0)x(0, 1, 1, 12)12 - AIC:5274.329959463097

ARIMA(0, 1, 0)x(1, 0, 0, 12)12 - AIC:5569.411464272851

ARIMA(0, 1, 0)x(1, 0, 1, 12)12 - AIC:5530.843450980574

ARIMA(0, 1, 0)x(1, 1, 0, 12)12 - AIC:5320.65575631255

ARIMA(0, 1, 0)x(1, 1, 1, 12)12 - AIC:5269.395081982428

ARIMA(0, 1, 1)x(0, 0, 0, 12)12 - AIC:6019.6445211383925

ARIMA(0, 1, 1)x(0, 0, 1, 12)12 - AIC:5691.054277950849

ARIMA(0, 1, 1)x(0, 1, 0, 12)12 - AIC:5468.475109996415

ARIMA(0, 1, 1)x(0, 1, 1, 12)12 - AIC:5179.1192748126205

ARIMA(0, 1, 1)x(1, 0, 0, 12)12 - AIC:5680.107572974952

ARIMA(0, 1, 1)x(1, 0, 1, 12)12 - AIC:5630.9405249553

ARIMA(0, 1, 1)x(1, 1, 0, 12)12 - AIC:5244.363316874456

ARIMA(0, 1, 1)x(1, 1, 1, 12)12 - AIC:5180.138355280625

ARIMA(1, 0, 0)x(0, 0, 0, 12)12 - AIC:6203.566418467412

ARIMA(1, 0, 0)x(0, 0, 1, 12)12 - AIC:5811.533567784873

ARIMA(1, 0, 0)x(0, 1, 0, 12)12 - AIC:5518.562759701984

ARIMA(1, 0, 0)x(0, 1, 1, 12)12 - AIC:5259.482683831171

ARIMA(1, 0, 0)x(1, 0, 0, 12)12 - AIC:5729.444733708864

ARIMA(1, 0, 0)x(1, 0, 1, 12)12 - AIC:5728.438134961931

ARIMA(1, 0, 0)x(1, 1, 0, 12)12 - AIC:5266.757771472065

ARIMA(1, 0, 0)x(1, 1, 1, 12)12 - AIC:5260.778758614272

ARIMA(1, 0, 1)x(0, 0, 0, 12)12 - AIC:6031.1654983224

ARIMA(1, 0, 1)x(0, 0, 1, 12)12 - AIC:5687.269280606292

ARIMA(1, 0, 1)x(0, 1, 0, 12)12 - AIC:5474.543180061646

ARIMA(1, 0, 1)x(0, 1, 1, 12)12 - AIC:5194.401187991937

ARIMA(1, 0, 1)x(1, 0, 0, 12)12 - AIC:5644.028869095402

ARIMA(1, 0, 1)x(1, 0, 1, 12)12 - AIC:5613.990399110331

ARIMA(1, 0, 1)x(1, 1, 0, 12)12 - AIC:5234.465961382581

ARIMA(1, 0, 1)x(1, 1, 1, 12)12 - AIC:5195.756676672797

ARIMA(1, 1, 0)x(0, 0, 0, 12)12 - AIC:6138.097777417985

ARIMA(1, 1, 0)x(0, 0, 1, 12)12 - AIC:5703.459036074439

ARIMA(1, 1, 0)x(0, 1, 0, 12)12 - AIC:5508.443461569642

ARIMA(1, 1, 0)x(0, 1, 1, 12)12 - AIC:5231.203130757599

ARIMA(1, 1, 0)x(1, 0, 0, 12)12 - AIC:5501.226799583273

ARIMA(1, 1, 0)x(1, 0, 1, 12)12 - AIC:5672.90736671603

ARIMA(1, 1, 0)x(1, 1, 0, 12)12 - AIC:5253.108626290737

ARIMA(1, 1, 0)x(1, 1, 1, 12)12 - AIC:5229.252731741912

ARIMA(1, 1, 1)x(0, 0, 0, 12)12 - AIC:6020.83830843927

ARIMA(1, 1, 1)x(0, 0, 1, 12)12 - AIC:5691.195529597255

ARIMA(1, 1, 1)x(0, 1, 0, 12)12 - AIC:5470.086899925115

ARIMA(1, 1, 1)x(0, 1, 1, 12)12 - AIC:5181.080072613651

ARIMA(1, 1, 1)x(1, 0, 0, 12)12 - AIC:5657.138075950534

ARIMA(1, 1, 1)x(1, 0, 1, 12)12 - AIC:5630.675745612928

ARIMA(1, 1, 1)x(1, 1, 0, 12)12 - AIC:5227.068484061379

ARIMA(1, 1, 1)x(1, 1, 1, 12)12 - AIC:5182.072520325035

lowest result is 5179.1192748126205So our parameters are (0, 1, 1) and (0, 1, 1, 12)

mod = sm.tsa.statespace.SARIMAX(y,

order=(0, 1, 1),

seasonal_order=(0, 1, 1, 12),

enforce_stationarity=False,

enforce_invertibility=False)

results = mod.fit()

print(results.summary().tables[1])==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ma.L1 -0.6213 0.040 -15.501 0.000 -0.700 -0.543

ma.S.L12 -0.5424 0.048 -11.297 0.000 -0.636 -0.448

sigma2 2.939e+07 4.56e-10 6.44e+16 0.000 2.94e+07 2.94e+07

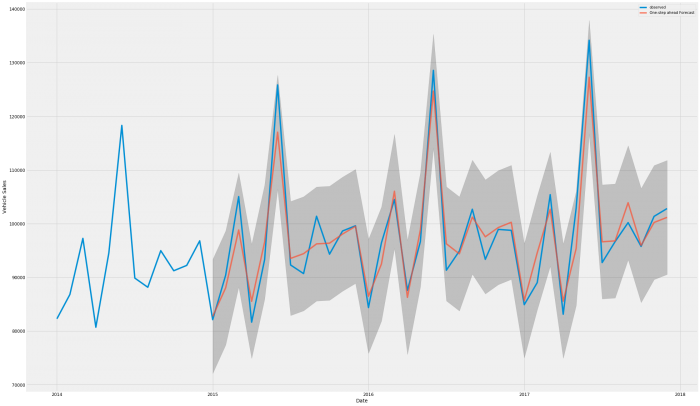

==============================================================================To check how well the model fits we’ll run it alongside known data first in case it needs more fine-tuning.To check how well the model fits we’ll run it alongside known data first in case it needs more fine-tuning.To check how well the model fits we’ll run it alongside known data first in case it needs more fine-tuning.

pred = results.get_prediction(start=pd.to_datetime('2015-01-01'), dynamic=False)

pred_ci = pred.conf_int()

ax = y['2014':].plot(label='observed')

pred.predicted_mean.plot(ax=ax, label='One-step ahead Forecast', alpha=.7, figsize=(30, 20))

ax.fill_between(pred_ci.index,

pred_ci.iloc[:, 0],

pred_ci.iloc[:, 1], color='k', alpha=.2)

ax.set_xlabel('Date')

ax.set_ylabel('Vehicle Sales')

plt.legend()

plt.show()

That looks pretty good, the high and low months in particular fit very closely, there is some error in the middle months so let’s see how it compares overall

y_forecasted = pred.predicted_mean

y_truth = y['2015-01':]

mse = ((y_forecasted - y_truth) ** 2).mean()

print('The Mean Squared Error of our forecasts is {}'.format(round(mse, 2)))

print('The Root Mean Squared Error of our forecasts is {}'.format(round(np.sqrt(mse),2)))The Mean Squared Error of our forecasts is 12947625.33

The Root Mean Squared Error of our forecasts is 3598.28Ok, so approximately 3600 is pretty good when you’re talking 80,000 to 130,000 per month

pred_uc = results.get_forecast(steps = 48)

pred_ci = pred_uc.conf_int()

ax = y.plot(label = 'observed', figsize = (30, 20))

pred_uc.predicted_mean.plot(ax=ax, label='Forecast')

ax.fill_between(pred_ci.index,

pred_ci.iloc[:, 0],

pred_ci.iloc[:, 1], color = 'k', alpha = .25)

ax.set_xlabel('Date')

ax.set_ylabel('Car Sales')

plt.legend()

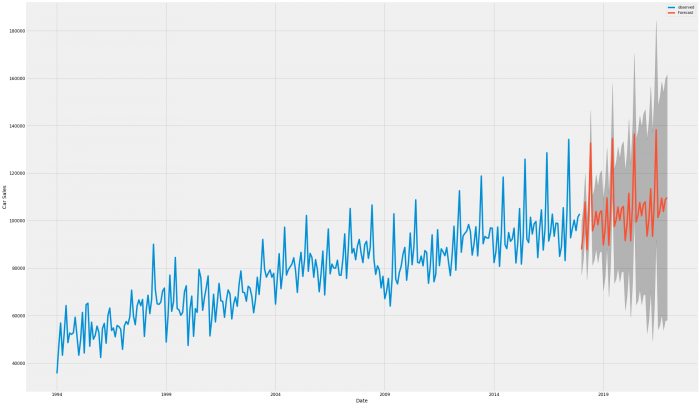

plt.show()

That certainly looks like it continues the pattern of the previous years.

Now while we don’t have access to the detailed data for 2018 to date, we do have access to various third-party reports that discuss the totals, i have compiled this data using Cox Automotive’s monthly report to check our model against

pred_uc2 = results.get_forecast(steps = 10)

prediction = pred_uc2.predicted_mean

prediction.to_csv("2018forecast.xls")prediction = pd.read_csv("2018forecast.xls", header = None)

prediction.columns = ['Time', 'Value']

print('2018 Prediction \n')

print(prediction)

prediction.to_csv("2018forecast.xls")

print('\n \n')

print('2018 YTD actual data \n')

df2 = pd.read_excel("2018YTD.xls")

print(df2)2018 Prediction

Time Value

0 2018-01-01 87835.521780

1 2018-02-01 94719.598479

2 2018-03-01 107766.389743

3 2018-04-01 87720.943587

4 2018-05-01 102595.203293

5 2018-06-01 132661.717537

6 2018-07-01 95666.385156

7 2018-08-01 98341.484265

8 2018-09-01 103847.180318

9 2018-10-01 98256.828271

2018 YTD actual data

TIME Value

0 2018-01-01 88551

1 2018-02-01 95999

2 2018-03-01 106988

3 2018-04-01 82930

4 2018-05-01 100754

5 2018-06-01 130300

6 2018-07-01 85551

7 2018-08-01 95221

8 2018-09-01 94711

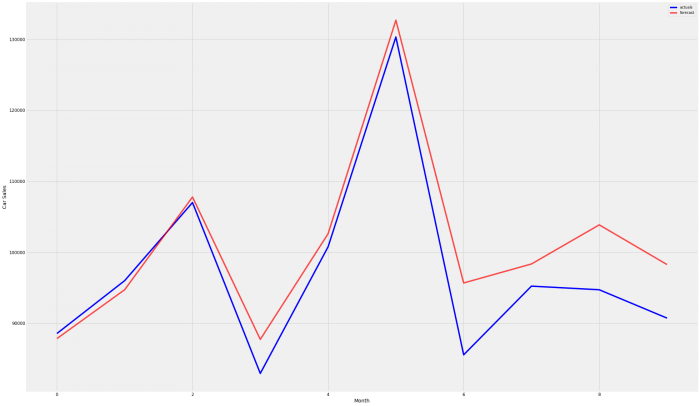

9 2018-10-01 90718That looks pretty good, let’s graph that and get our total variance

prediction = pd.read_csv("/home/paul/Documents/Portfolio/New_vehicle_sales/2018forecast.xls")/

ax = df2['Value'].plot(label = 'actuals', figsize = (30,20), color = 'b')

prediction['Value'].plot(ax = ax, label = 'forecast',color = 'r', alpha = 0.7, figsize = (30, 20))

ax.set_xlabel('Month')

ax.set_ylabel('Car Sales')

plt.legend()

plt.show()

prediction_total = int(prediction['Value'].sum())

actuals_total = round(df2['Value'].sum(), 2)

variance = round(prediction_total - actuals_total, 2)

variance_percentage = round(((prediction_total / actuals_total) - 1) * 100, 2)

print('total prediction YTD for 2018 was ' + str(prediction_total))

print('total actuals YTD for 2018 was ' + str(actuals_total))

print('total variance is ' + str(variance) + ' or ' + str(variance_percentage) + '%')total prediction YTD for 2018 was 1009411

total actuals YTD for 2018 was 971723

total variance is 37688 or 3.88%So far the forecasted results look to be consistently slightly higher than the actual results, we will examine the cause for this inaccuracy closer to determine if it was car type-based or possibly region-based, or an overall trend change. The final step for this article will be to save the 4 years of forecast data and print it for any further examination.

prediction_4_year = pd.DataFrame(pred_uc.predicted_mean)

prediction_4_year.to_csv("/home/paul/Documents/Portfolio/New_vehicle_sales/4_year_forecast_all.xls")prediction_4_year = pd.read_csv("/home/paul/Documents/Portfolio/New_vehicle_sales/4_year_forecast_all.xls")

prediction_4_year.columns = ['TIME', 'Value']

print('4 Year Prediction \n')

print(prediction_4_year)

prediction_4_year.to_csv("/home/paul/Documents/Portfolio/New_vehicle_sales/4_year_forecast_all.xls")4 Year Prediction

TIME Value

0 2018-01-01 87835.521780

1 2018-02-01 94719.598479

2 2018-03-01 107766.389743

3 2018-04-01 87720.943587

4 2018-05-01 102595.203293

5 2018-06-01 132661.717537

6 2018-07-01 95666.385156

7 2018-08-01 98341.484265

8 2018-09-01 103847.180318

9 2018-10-01 98256.828271

10 2018-11-01 103181.269135

11 2018-12-01 104130.896814

12 2019-01-01 89698.643506

13 2019-02-01 96582.720205

14 2019-03-01 109629.511469

15 2019-04-01 89584.065313

16 2019-05-01 104458.325018

17 2019-06-01 134524.839263

18 2019-07-01 97529.506882

19 2019-08-01 100204.605991

20 2019-09-01 105710.302044

21 2019-10-01 100119.949997

22 2019-11-01 105044.390861

23 2019-12-01 105994.018540

24 2020-01-01 91561.765232

25 2020-02-01 98445.841931

26 2020-03-01 111492.633195

27 2020-04-01 91447.187039

28 2020-05-01 106321.446744

29 2020-06-01 136387.960989

30 2020-07-01 99392.628608

31 2020-08-01 102067.727717

32 2020-09-01 107573.423770

33 2020-10-01 101983.071723

34 2020-11-01 106907.512587

35 2020-12-01 107857.140266

36 2021-01-01 93424.886958

37 2021-02-01 100308.963657

38 2021-03-01 113355.754921

39 2021-04-01 93310.308765

40 2021-05-01 108184.568470

41 2021-06-01 138251.082715

42 2021-07-01 101255.750334

43 2021-08-01 103930.849443

44 2021-09-01 109436.545496

45 2021-10-01 103846.193449

46 2021-11-01 108770.634313

47 2021-12-01 109720.261992For a first forecast with no refinement, 3.88% is pretty good, I’m sure we can get better with some more refinement of the segmentation and dates which we will do in Part 2 of this blog.

If you are interested in the source code see my GitHub.

Leave a Reply